Stock market and share prices are near record highs. At the same time, Republicans and Democrats alike bemoan a sluggish recovery that has left too many behind. As delegates gather in Philadelphia this week, I wonder how many of the speakers will address this disconnect seriously, especially when so many there contributed to this situation. No one talked about this in Cleveland.

Pay inequity is a hot topic. It cuts across all income groups. Women fight for pay equal to that of men performing the same job. Others broaden the push for pay equity to include jobs of comparable value or requiring similar training and experience.

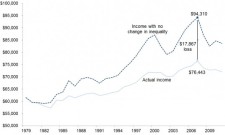

Some of the most shocking disparities occur in the gap between what CEO’s and the average worker make. According to Fortune Magazine, CEO’s make 300 times what the average worker earns. For the top CEO’s, the multiple is 373 times. What’s more to the point, however, is that from 1978 to 2014, CEO pay grew 1000 percent, while average worker income increased by just 11 percent.

Ah, but you say, aren’t those CEO’s worth every cent? Isn’t their growth central to their company’s well-being and the health of the economy. Not so fast. Today’s Wall Street Journal reports on a study by corporate research firm MSCI that found that the best paid CEO’s run some of the worst-performing companies as measured by stock performance over a ten-year period. And the results of lower paid CEOs were best. The results held whether the researchers analyzed across all companies or on a sector-by-sector basis.

According to the Economic Policy Institute, in 1965, CEOs earned an average of $832,000 a year while workers earned $40,200. By 2014, CEO pay had grown to $16,316,000 while workers were getting just $53,200. The study noted that this was not linked to productivity. It was just that the guys at the top were taking a bigger slice of the pie.

We’re a market-driven economy, and people should be able to get what they’re worth, or more if they can work that out. But a regulatory shift, supported by Democrats and Republicans alike, distorts the compensation game. Stock option incentives and corporate buybacks now make legal acts once deemed market manipulation, and may have contributed to some of the recent bubbles.

One of the major problems is that Bill Clinton’s administration, in an effort to curb grossly excessive CEO salaries, decided that corporations could write off salaries in excess of $1 million only if the companies met certain performance metrics. One was stock prices. So corporations started to do stock buy-backs to artificially boost stock prices, thus perversely inflating those same CEO salaries, without benefitting employees, consumers or the long-term health of the economy. Today’s study tells us that even investors in these companies lose out.

If you want to be charitable, call it the law of unintended consequences. We’d have a much better handle on these trends if the Securities and Exchange Commission reported salary inflation over a ten-year period rather than one year at a time.

Candidates Clinton and Trump should be asked whether their administrations would do that. And they should be asked whether, as Rana Foroohar asked in Time Magazine, whether it’s time to rethink buybacks and stock options that encourage executives to focus more on share price than other metrics.

These discussions often get too complicated for the short attention span of most of us as we follow the news. But it’s a legitimate issue to be raised in some larger debate on the economy and its inequities. Especially when some of Bill Clinton’s key economic advisers are part of Hillary’s team.

At a minimum, boards of directors need to scrutinize CEO pay more closely, and more clearly align remuneration and perks with how a company produces and how it treats its employees. Failure to do that will continue to foster the kinds of understandable resentment that has fueled much of this year’s populist discontent.

I welcome your comments in the section below. To be alerted when a new blog is posted, click on “Follow’ in the lower right portion of your screen.